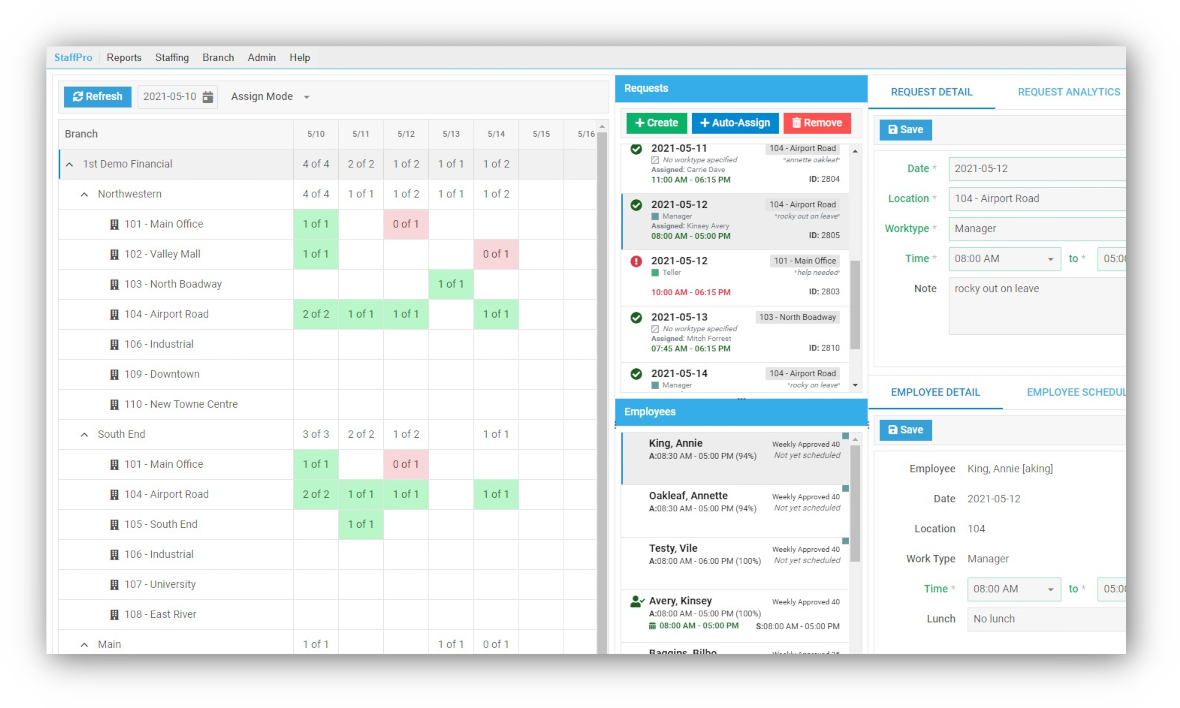

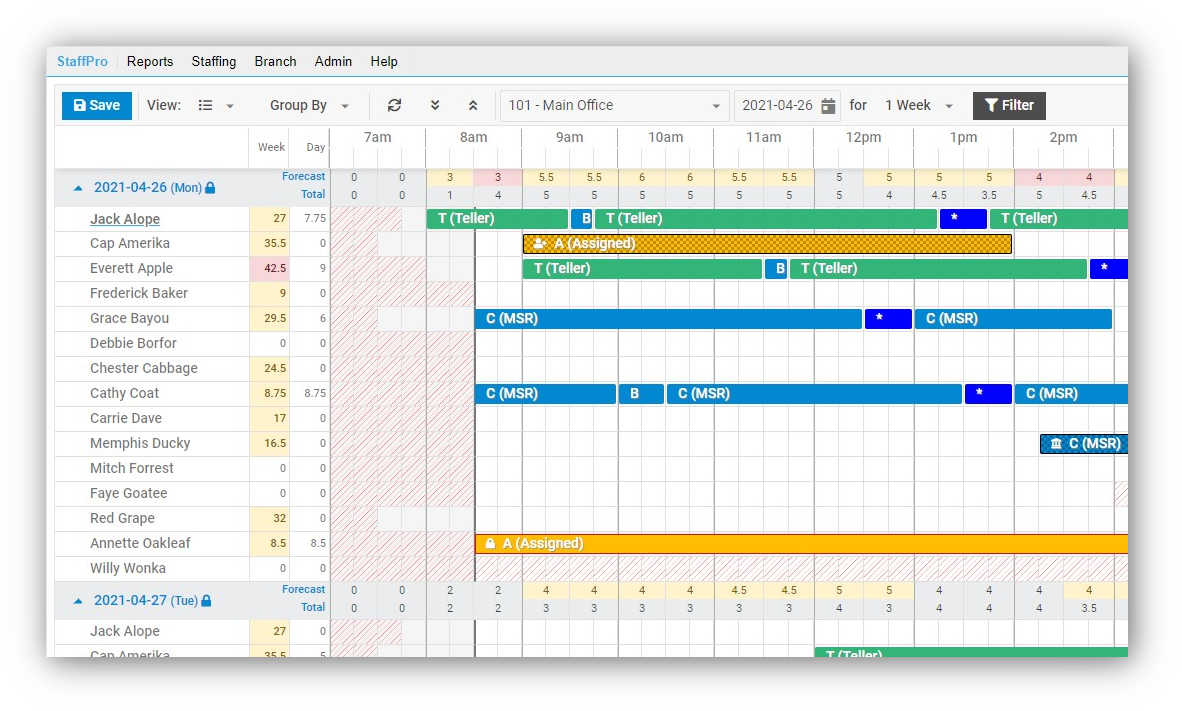

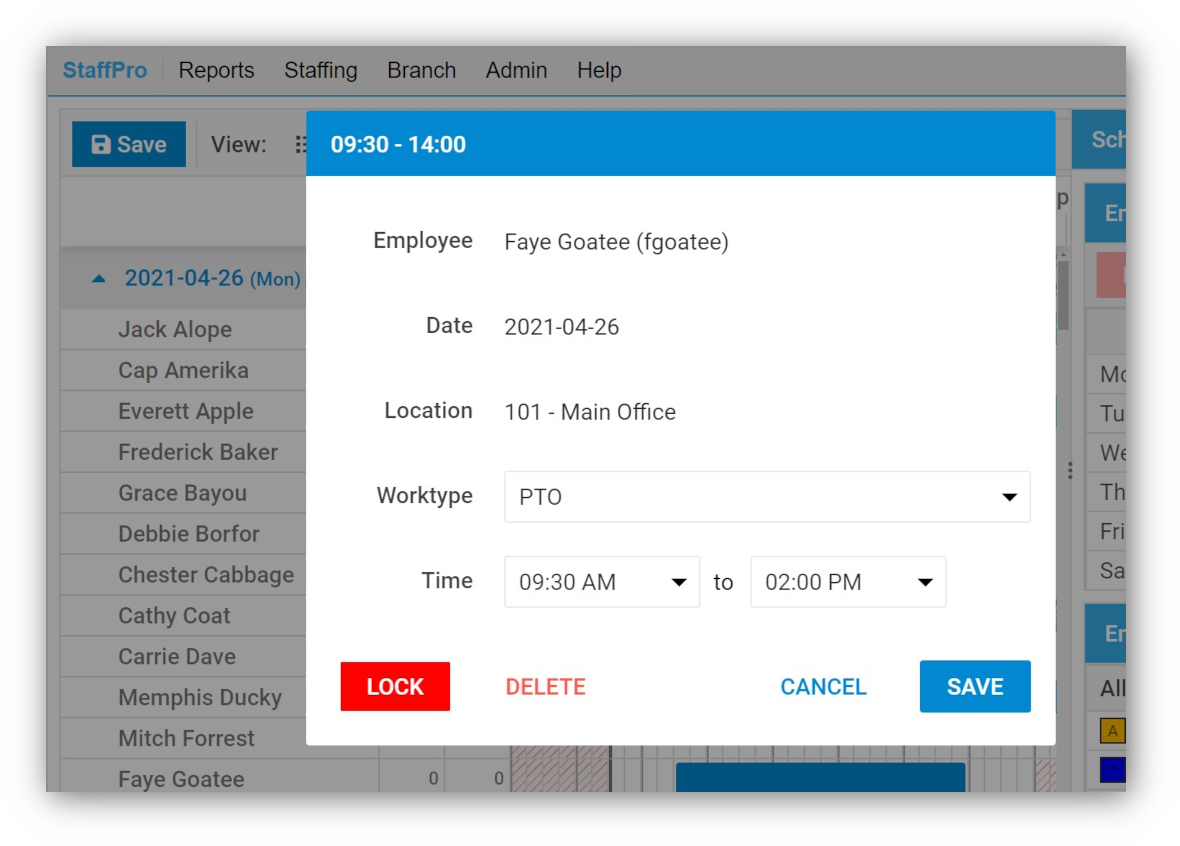

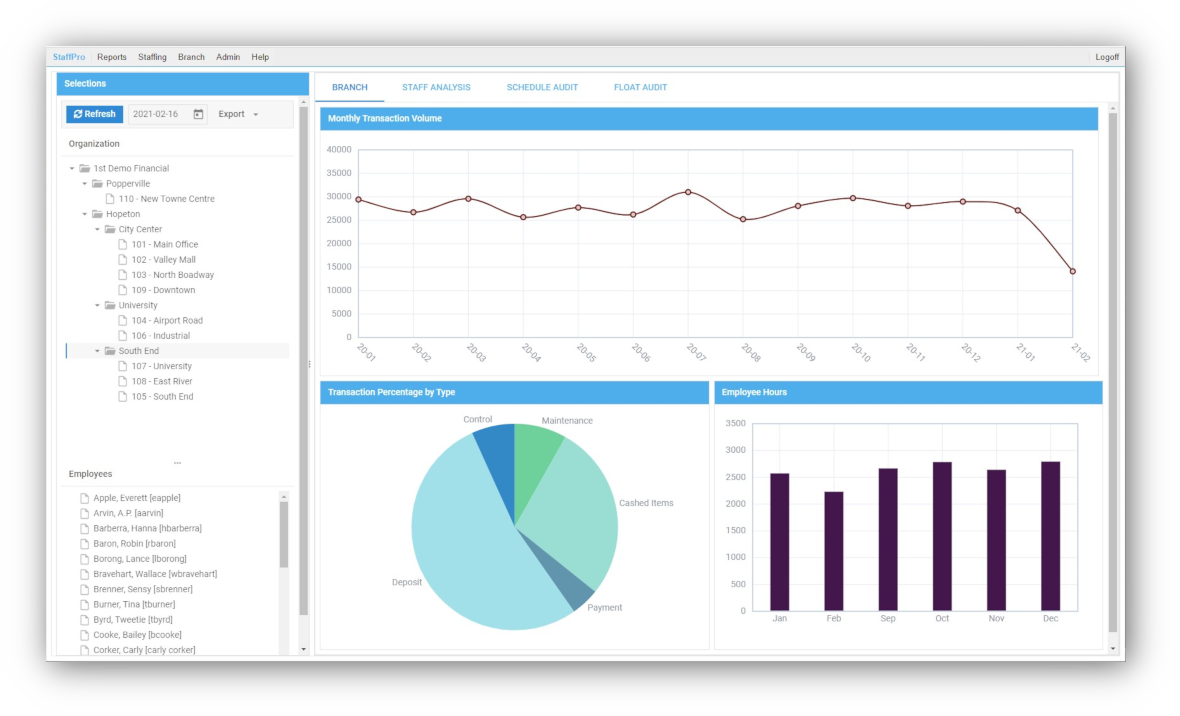

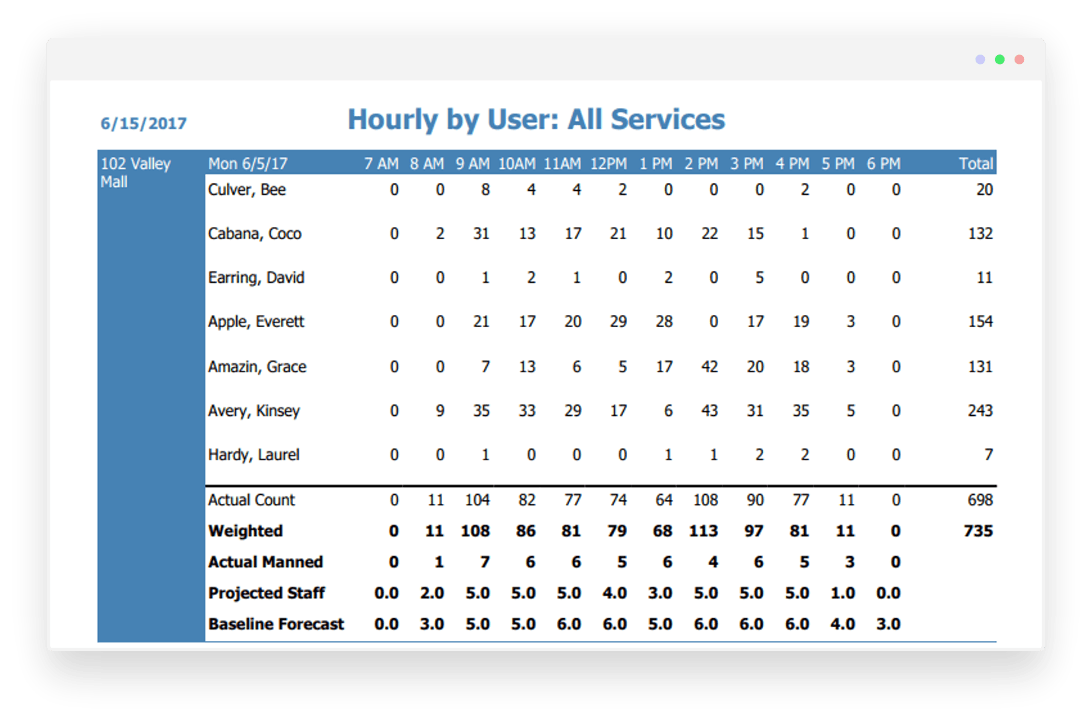

StaffPro automates the difficult task of scheduling float staff. With eight configurable scoring criteria, StaffPro evaluates and matches the best fit employee(s) to fulfill each request. A dedicated page for float managers lets them quickly see overall pool schedules, reassign staff and manage request details.

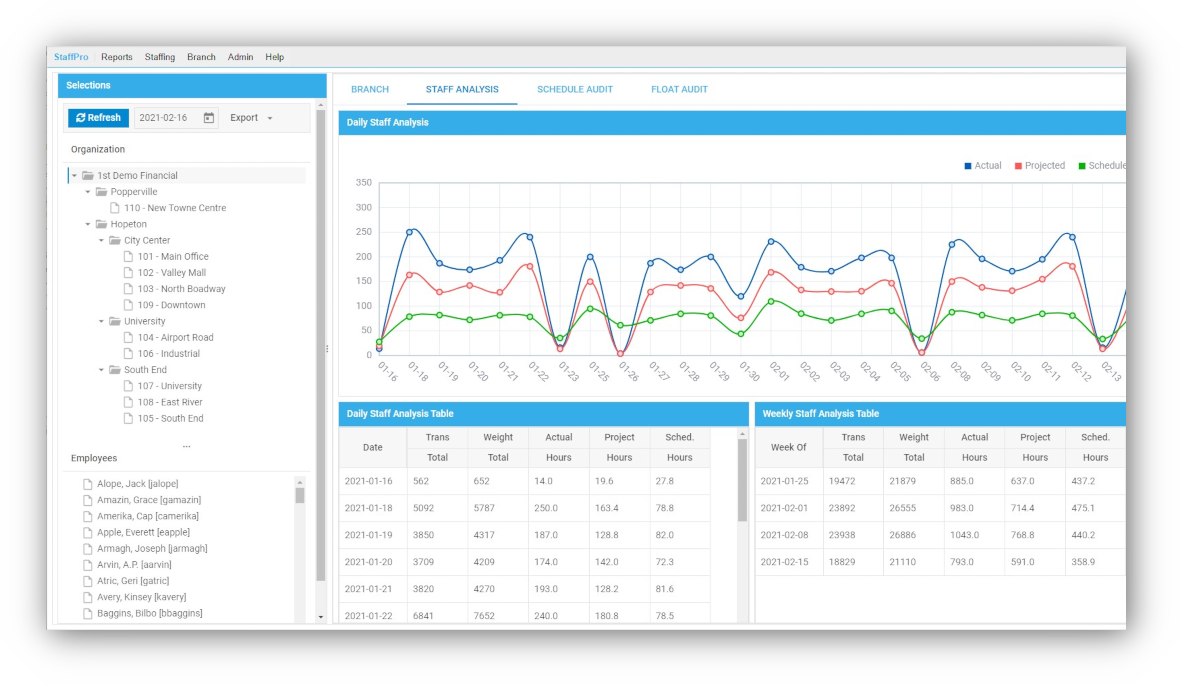

Optional Forecasted Float happens immediately after automated scheduling finishes. It ranks all branches according to need and assigns specifically designated float employees that can best meet that need. If the employee is already scheduled at another branch, StaffPro only makes the assignment if there is a net benefit to the organization.

One recent innovation to improve branch profitability is to share expensive specialists such as Managers, Financial Advisors, Commercial or Mortgage loan officers, Small Business Advisors, Trust, etc.; across groups of branches. StaffPro's float feature can be configured to help schedule, coordinate, manage and see shared resources across branch clusters and the Enterprise.

Learn More